Clients, friends, and colleagues:

Recent market movements may be causing some concern, and I want to take a moment to both acknowledge your feelings and provide some perspective during this time of volatility.

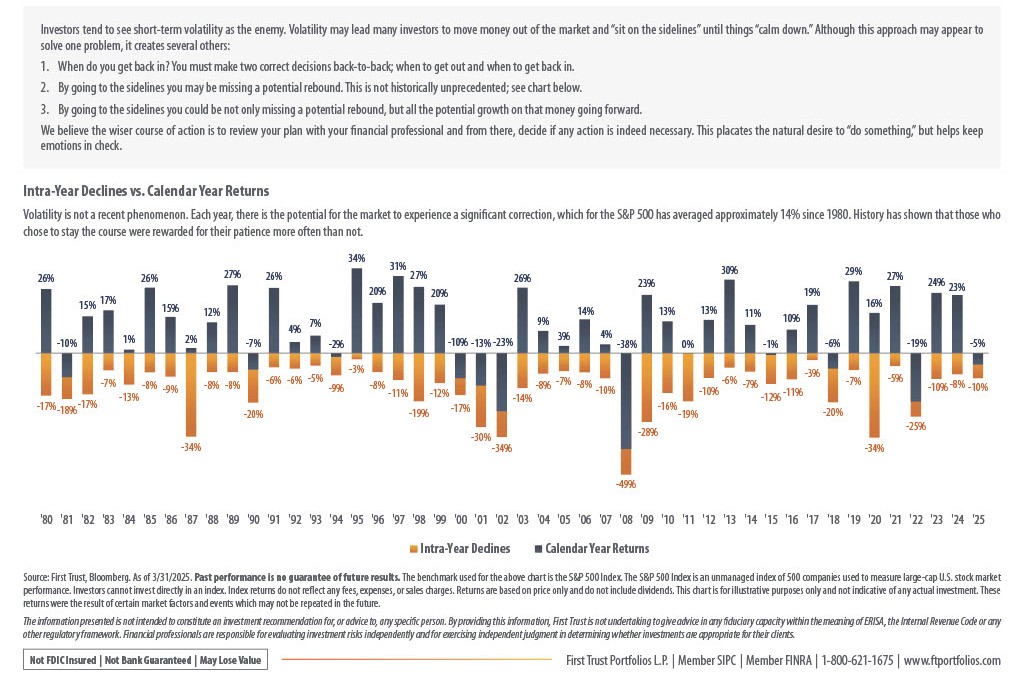

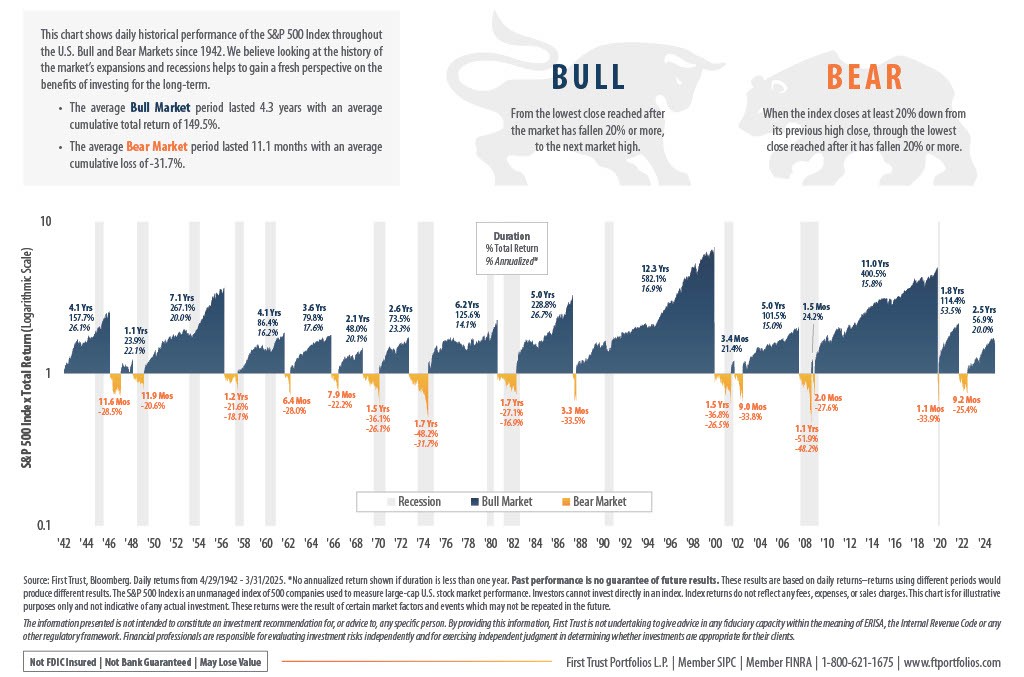

Market fluctuations, while unsettling, are a natural part of investing. History shows that patience and a well-thought-out-strategy tends to reward those who stay the course rather than reacting to short-term volatility. Below are 2 powerful charts from First Trust.

The first slide below shows Intra-Year Declines in the S&P 500. As you will see, it’s normal to see large swings even in years that the market ended positively (recent examples: 2016, 2017, 2019, 2020, 2021, 2023 and many more).

The next chart shows the History of U.S. Bear & Bull Markets. The average Bull (UP) Market lasts 4.3 years with average cumulative total returns of 149%. While the average Bear (DOWN) market has lasted 11.1 months with an average cumulative loss of -31.7%.

If you’re feeling uncertain or want to revisit your plan with me, I am here. I’m more than happy to revisit your portfolio, risk, financial plan, goals, time horizon anytime. Your peace of mind is my top priority. Please don’t hesitate to reach out to me directly with any questions.

As always, thank you for your partnership with our firm.