I hope you are enjoying your summer. Some highlights from my family include: a trip to Arkansas to see relatives, Emma enjoyed her first firework show, and our tomatoes are bountiful and finally ripening in the garden! As for Angel, her oldest son recently bought a home and got engaged. Also, her younger son just graduated from high school and he’s off to Perdue University this Fall for their Honors Program. She and her husband, Grant, are learning what it’s like to be empty-nesters… so wish her luck and offer any pointers the next time you talk to her. 😊

The other day, I attended a webinar, Mid-Year Insights and Outlook, with a presentation by Dr David Kelly. He’s the Chief Global Strategist and Head of Global Market Insights at J.P. Morgan and has 34 years of experience in the industry. I wanted to pass along a few things that I thought would be relevant to many of you …

- Inflation: When we talk about inflation coming down, it is important to recognize that we are not saying that PRICES are coming down. The prices we had in 2019 are gone. Just like prices from the 1960s or 1970s are gone. The rate of growth of prices (inflation), however, has come down. Price growth came down from 9.1% year-over-year (June 2022), to 3.0% year-over-year (June 2024).

- Cash isn’t necessarily king: If you look at the last 7 cycles of the Federal Reserve raising interest rates, putting CD rates at their peak, and then you fast forward 12 months from that peak CD rate, want to know what happens? Six out of 7 times historically, the stock market beat CDs, and usually by A LOT. Cash is important for short term liquidity but historically CDs, even at their peak, don’t beat the market over the preceding 12 months, not even if you have a 60/40 (stock/bond) portfolio.

- 68% of GDP is Consumption … and the bottom line is people are still spending money. What we learned over the last few years, or as Kelly argues, what we shouldn’t have forgotten, is that American consumers are arguably the most reckless in the world. Americans, with the exception of our clients of course 😉 , spend money they don’t have to buy stuff they don’t need. The pandemic aide caused an increase in credit card debt. That plus wage growth allowed consumer spending to grow more quickly even while the Federal Reserve has tried slowing the economy.

- 38% of the S&P 500 Index is in just 10 companies! There is potentially a lot of froth in these mega-cap companies and Kelly said that if you have fresh money to put into the market, consider this concentration risk and look outside the mega-caps. If we have a market correction, chances are the things that went up the most, could go down the most. (Look at the year 2022.) If you’re a long-term investor, consider being less concentrated. If you are a client with the firm, this is already considered in your allocations.

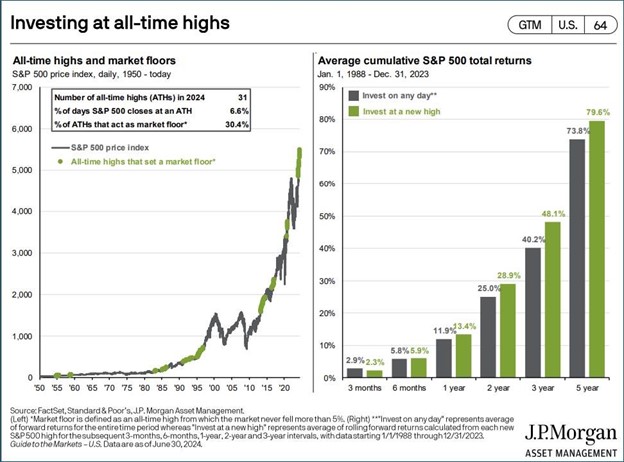

- Don’t be afraid to invest when the market hits new all-time highs: As it turns out, you make more money investing on days that the market hits all-time highs than if you wait and invest on any other day. Reason? The market is very momentum driven. So again, consider investing outside the mega-caps, but Kelly argues that long-term investors shouldn’t be afraid to put new money into the market, even now.

See chart:

- Finally a note on rate cuts: Investors expect the Federal Reserve will cut rates about 25 basis points (or a quarter of a percent) in September ’24 and December ’24. Then, the current expectation is that the Feds cut rates 4 more times next year (25 basis points each).

(Click here for source of information above)

4(40%)

Thank you as always for reading this. Watch for an invitation to an upcoming workshop: Aging Parent Round Table. This event is gaining traction in Kansas City. I got to attend one a few months ago and this will be packed with great information and of course, you’ll also get a good meal. You do NOT have to be a client of our firm to attend. In fact, we welcome people to come to our events (that are not clients) to see what they are all about… Lastly, I cannot say it enough: Thank you all for your support, partnership, and TRUST.

Enjoy the rest of your Summer!