I hope you’ve enjoyed your Summer so far. Last week our tomatoes FINALLY started ripening so we could enjoy the fruits of our labor. Our 19 month old daughter, Emma, absolutely LOVES to be outdoors. One thing we do every night after dinner now is go outside and watch her find, pick, and EAT the red, ripe tomatoes. With so much negative news this year, I thought we could all use something positive and fun. Angel put together a Garden Collage with photos we’ve gotten from some of you of your own gardens. See our Facebook or Linkedin in pages to see our pictures.

Speaking of the news, you can’t make it through a day without hearing the word, “recession” right now. Or at least, in my profession, I can’t. Everyone is wondering if we are in one and weighing in with their opinions – often times, politically driven ones at that. Macroeconomic textbooks define recession as two consecutive quarters of negative growth in GDP, which we now have seen. Historically, this has been a very good indicator of recessions too. Technically, however, the National Bureau of Economic Research (NBER) looks at GDP and a variety of other factors to determine if we are or not. … And when do they do that? I’d say when it almost no longer matters.

We had Chris Kuehl, chief economist for several national and international organizations, out to speak to our clients and their guests in January 2022. By the way, we already have him booked for January 2023 – stay tuned! … I heard him interviewed on the radio yesterday and when asked if we are in recession, he said, “it depends. If you ask people that work in some sectors, they’d say they are having their best year ever. Others would say we’ve been in a recession for 3 months.”

Liz Ann Sonders, Chief Investment Strategist at Schwab, said she’s surprised we’re even talking about a recession. “To be honest,” she said, “it doesn’t matter that much. Growth is weak. We are in a bear market. Whether or not it is a recession, we wait and see.” A client of mine in a review the other day said it’s just a word. I liked that response.

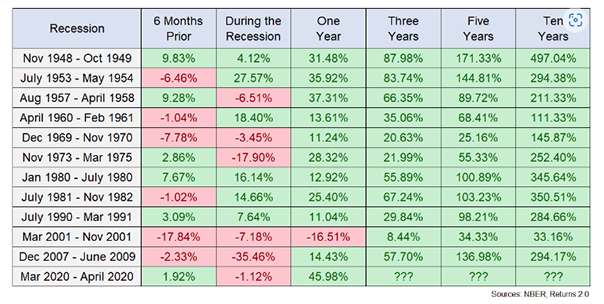

Whether the NBER later declares this to officially be a recession or not, keep in mind, the stock market is a LEADING (not lagging) economic indicator. This means it tends to go up before the bad news is over. Here’s a chart of what the market has done historically during and right after recessions. There were 3 occurrences where the market finished in the green 6 months prior, during, AND 1 year after the recession ended. There were 6 occurrences where the markets finished green during recession and only once where it finished negative 1 year after a recession.